Present value of lease payments financial calculator

A company ABC Co leases and asset for five years. Use our online present value of future minimum lease payments calculator to find the PV of future minimum lease payments.

How To Use An Hp 10bii Financial Calculator Propertymetrics

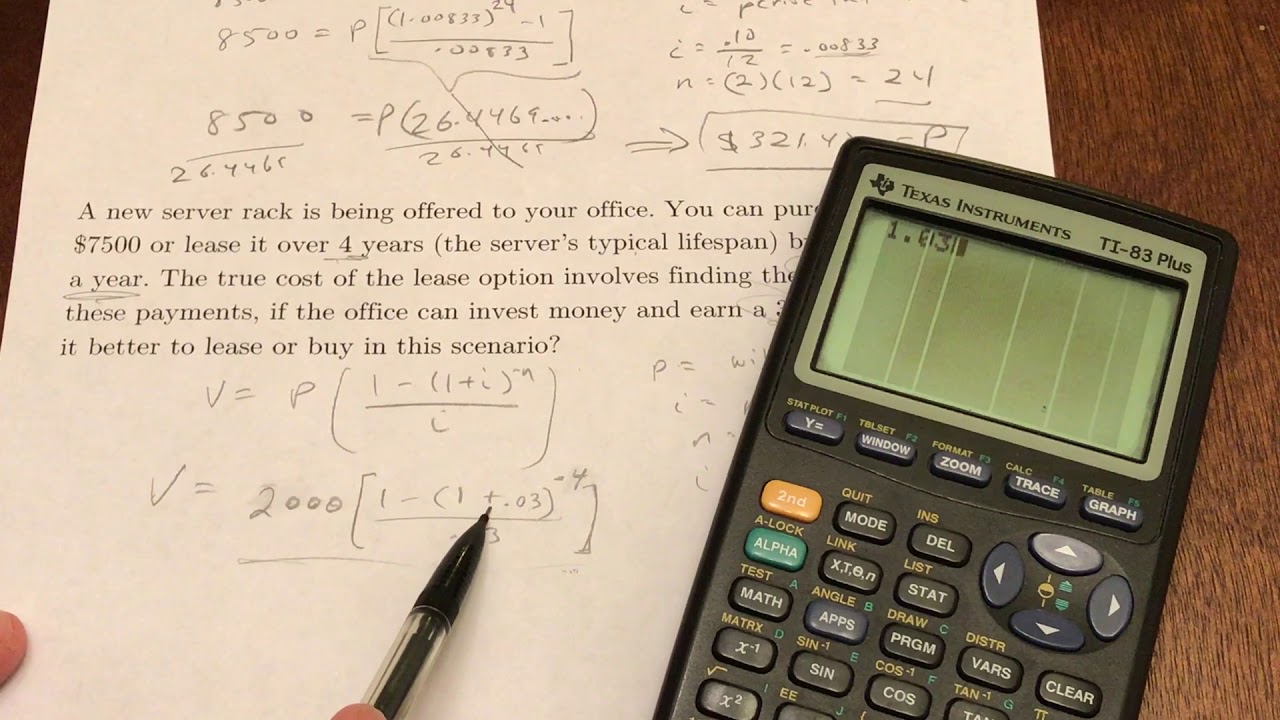

In this lesson we go through an example of how to calculate the Net Present Value NPV using the Financial Calculator EL 738.

. Measure lease liability by inputting the discount rate needed to then calculate the present value of lease payments. Present Value Calculation Download our Excel Template Here. Guide to Present Value Factor formula here we discuss its uses with practical examples and also provide you Calculator with downloadable excel template.

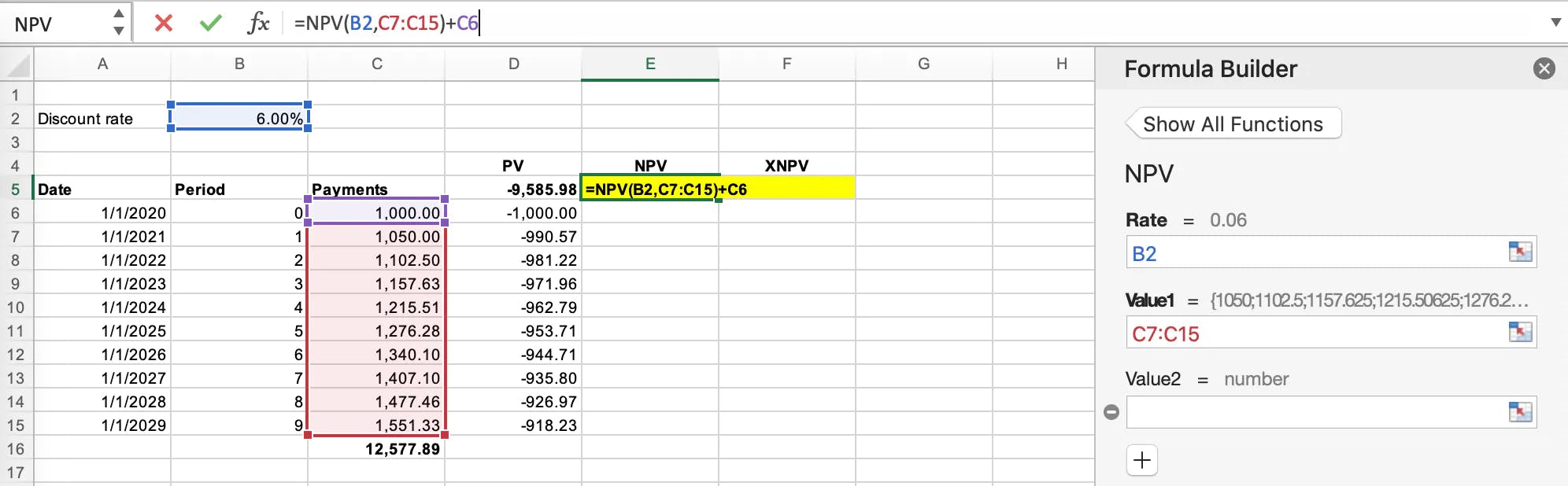

DOWNLOAD NOW With this present value excel calculator template youll be able to. PV of Minimum Lease Payment. In the example above we first take the present value of all of the annual lease payments individually.

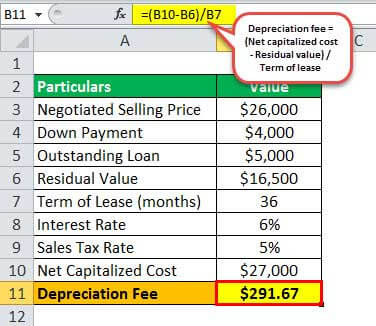

P4 Present Value Formula The formula of present value of minimum lease payments looks like this. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at. The monthly lease payments may be calculated using the mathematical formula.

Follow the steps below to calculate the present value of lease payments and the lease liability amortization schedule using Excel when the payment amounts are not constant illustrated with an example. The calculator uses the monthly lease payments formula based on the present value of an annuity as follows. The principle of value additivity states that the present value lease amount is equal to the present value of the monthly payments an annuity plus the present value of the residual.

Comply with ASC 842 standards with accurate present value calculations. It is most commonly associated with car leasing. PV SUM P 1r n RV 1r n Where PV Present Value P Annual Lease Payments r Interest rate n number of years in the lease term RV residual value.

Capitalize your leases based on the present value of lease payments. Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease. Calculate the present value of lease payments for a 10-year lease with annual payments of 1000 with 5 escalations annually paid in advance.

The lessor is usually a lease company or finance company. The present value of the lease liability of the leased asset as calculated by the company equals 100000. Check it outNet Present Val.

A lease is a method of financing the use of an asset and is an agreement between a lessee who rents the asset and a lessor who owns the asset. PMT PV FV 1in 1 1 1in I PMT PV FV 1in 1 1 1in I The cost of the leased. PV Present Value CF Future Cash Flow r Discount Rate t Number of Years Inputs In order to calculate.

Some equipments are taken for lease since the company. Get your credit karma are called a. 4319 27232 31551.

How To Calculate The Present Value Of Future Lease Payments

Monthly Lease Payment Calculator Plan Projections

80 Best Financial Planning Calculators

Lease Payment Formula Example Calculate Monthly Lease Payment

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments Excel Occupier

Lease Payment Formula Example Calculate Monthly Lease Payment

Ba Ii Plus Ordinary Annuity Calculations Pv Pmt Fv Youtube

How To Calculate The Present Value Of Lease Payments In Excel

Present Value Calculation Tool For Ifrs 16 Asc 842 Leasequery

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

Calculating Payments For Present Value Ti 83 84 141 36 Youtube

Present Value For Lease Youtube

How To Calculate The Present Value Of Lease Payments In Excel